In the not so faraway future, wallets will become useless. In fact, if Samsung’s plan succeeds, you won’t need anything else when you leave the house but its Galaxy smartphone.

The famous Korean company has just launched Samsung Pay in Australia, bringing the contactless mobile payment platform Down Under by partnering with American Express and Citibank.

It means that starting today, Australians who own an Amex- or Citibank-issued card will be able to tap and pay at contactless terminals with their Samsung smartphone. However, the company mentioned the mobile payment method does not apply to Amex/Citibank branded cards from other banks.

After the US, Korea, China, and Spain, Australia has become the fifth major market where Samsung Pay has been launched. Any smartphone running Android 6.0 Marshmallow and above is compatible with the payment technology.

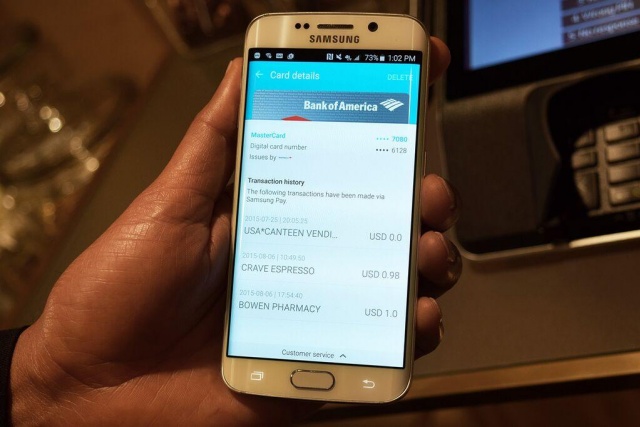

A simple swipe to pay interface makes Samsung Pay as easy as using a card, if not easier. But more than being simple to use, the tech is also very secure.

First, swipe up from the home screen to open payments; choose your card; hold your finger on the home button to verify fingerprint; and tap smartphone to a contactless terminal. The company assured its users that card details aren’t shared with retailers and other merchants.

Samsung is not the first to offer contactless payments in Australia; Apple Pay stole the show by launching alongside American Express in October 2015. By April, ANZ was brought into the fold in April, as well as several Australian banks, such as Commonwealth Bank.

But even though it might be a little late to the game, Samsung is more than eager to offer better deals. For example, it promised merchants and financial institutions that the company won’t take a “clip” of interchange fees (like Apple does).

The long-term goal of bringing Samsung Pay to more countries is that of getting more Samsung devices in the hands of more shoppers and smartphone users. As Elle Kim said, the global Vice President of Samsung Pay, “Everyone is so used to tapping and paying with their cards, we have to do more with their phones.”

Therefore, Samsung wants its payment platform to work anywhere. And while the Korean company is keen to work with banks, there might be some financial partners involved in the future.

Image Source: Let’s Talk Payments