Facebooks comes yet again, with a new way of expanding their technological empire. The new feature release by Facebook will allow people to transfer money via its Messenger app, using their credit cards.

Facebook Messenger app is among the largest chat platforms on the planet, and over 500 millions users use it every month. Last year, Facebook bought WhatsApp, with nearly $22 billion, and this is a separate messaging app that presently counts 700 million active users worldwide.

In the United States, Facebook is about to launch a money transfer system from one friend to another.

One of the most feared competitor for Facebook’s new offer is the mobile payment, Venmo, an app owned by eBay’s PayPal. Very popular among young users, what Facebook proposes is not just a payment system, but a social network that permits users to post public or private messages about the purpose of the money they are sending.

The e-commerce start-up, called Square, offers a similar app trough which people can send money via email. Also, Snapchat, the start up known for its messages that disappear, permits users also to send money to one another, trough a partnership with Square.

With the new service, Facebook wished to make simpler the process as much as possible, explained Steve Davis, the product manager who is leading the project.

“We know that conversations about money are happening all the time.”(…)“But most conversations begin in one place and end in another place,” stated Davis.

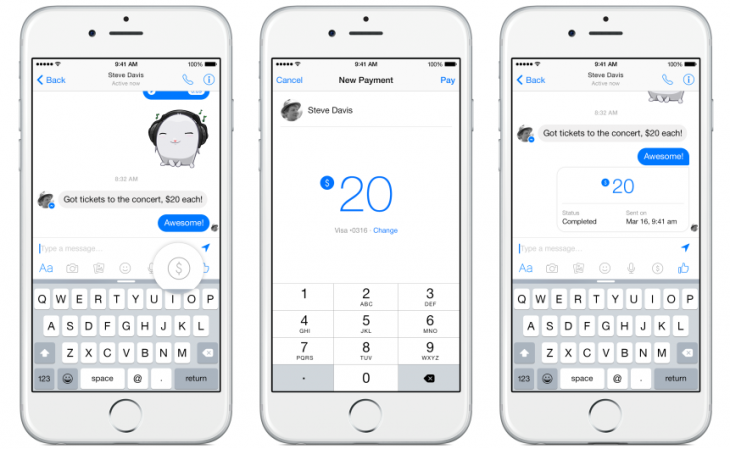

Facebook, is aiming to keep the payment and conversations in the same message, that could also be used as a record. So the new feature, will be easy to use, as right next to the thumbs up button on the Messenger chat, there will be a dollar sign that, if pressed you can send money.

If there already exists a debit card number saved in the app, you can send cash to the other person in the conversation by pressing the dollar sign and after, you enter the amount. The entire conversation will be saved to serve as later proof.

In order to minimize the risk of unauthorized money transfers, Facebook stated, that users must enter a PIN or they should use Apple’s fingerprint identification system, before they are allowed to send the cash.

The use of debit cards to help the transfer to happen, makes the money transfers between the two bank accounts pretty fast, and allows Facebook to offer this service for free to users. The difference between this and PayPal or Venmo, is that users don’t have to remember to withdraw the money later on, explained Davis.

Like many of the other Facebook features, the button for the Messenger payments will be progressively introduced to Messenger users from the U.S. over the coming months, and the option will be available on mobile apps but also on the web version.

For starters, the feature will be available to send money only between people who are friends on Facebook, meaning it will not compete right away with Apple Pay and other mobile payment services, that were created specially to help people to make their purchases more easy with their phones. According to Davis, the commercial market creates a completely different set of challenges.

Facebook has stated, that, there have been certain merchants, mainly overseas, who have been informally using Facebook Messenger to make money transactions.

Facebook has a payment business, that earned them almost $1 billion last year, most of the money coming from games that are hosted on its platform.

It has also been trying with an e-commerce system, that permits merchants to list things for sale and collect the cash from the purchases straight on the social network.

Wall Street has been, enthusiastically anticipating the addition of payments to Facebook Messenger since last June, when Facebook, hired David Marcus, the president of PayPal, to be in charge of its messaging plans.

In January, the chief executive of Facebook, Mark Zuckerberg, told analysts, that is expected for Messenger and WhatsApp, to bring in big money eventually, as he believed that both of these apps, will be huge contributors to their business in time, as long as they do it the right way.

Image Source: TNW, TNW

Latest posts by Karen Jackson (see all)

- Intoxicated South Carolina Man Punches Waitress Who Refused to Serve Him Alcohol - June 29, 2018

- Restaurant Manager Arrested and Charged in Shooting Death of Co-Worker over Negative Yelp Reviews - June 20, 2018

- Minnesota Teen Gets Head Stuck In Oversized Tailpipe Winstock Music Festival - June 18, 2018